PLP, a British company that is a partner of Ivanhoe Cambridge, has announced the closure of its second investment vehicle in the UK, UKLV2, dedicated to building a portfolio of logistics assets.

The company has an investment potential of over 50 750 million. Thus, this vehicle was funded Ivanhoe Cambridge. It is the majority investor in the management of the Fund, Peel L&P, The Greater Manchester Pension Fund and PLP.

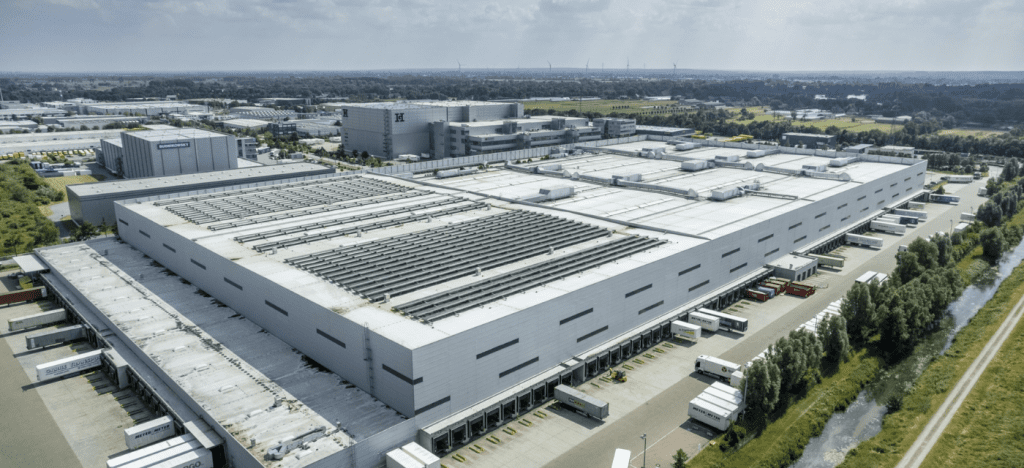

UKLV2 follows the success of PLP’s first investment vehicle, UKLV1. In the latter case, Ivanhoe Cambridge and several co-investors had made 500 million. The investment is set to create more than 929,000 square meters of prime logistics space.

Investment vehicle strategy involves creating and maintaining a long-term portfolio of logistics assets (“growth-holding”). Therefore, it would allow the UK to provide high quality assets located close to key integrations.

Stanislas Henry, Senior Vice President, Operations and Strategic Partnership, Europe, Ivanhoe CambridgeSays: Following the success of the initial vehicle developed between 2017 and 2022, we are pleased to be writing this new chapter in the development of PLP. As a historical and strategic partner, Ivanhoé Cambridge is pleased to renew confidence in the management and PLP team. , Which is highly integrated with our core financial performance objectives and ESG values. This investment strengthens our commitment to the European logistics sector, a key focus of our strategic plan. ⁇

“Certified food fanatic. Extreme internet guru. Gamer. Evil beeraholic. Zombie ninja. Problem solver. Unapologetic alcohol lover.”

More Stories

UK says ship attacked in Yemen

Benjamin Cohen, falsely accused of murders in Australia, files complaint and seeks compensation

“Joe taxes him. Biden wants 45% tax on “gains” in America, explanation in 2 pictures, because it will be the same in France!”. Edited by Charles Channott