Life as a couple is a long and winding river. Sometimes non-existent.

Throughout the stagnant waters, waterfalls and financial shoals, is there a perfect and universal way to manage your expenses?

Photo of Phil Benard, courtesy of Helen Bellow

Helen Bello is a full professor at the INRS Center for Urban Culture and Society

“No, there is no perfect way,” answers Hélène Bello, a professor at the National Institute for Scientific Research’s Center for Urban Culture and Society and author of several studies on couples and money. “There are contexts that need to be taken into account. Do the spouses want to manage separately or do they want to bring everything together? »

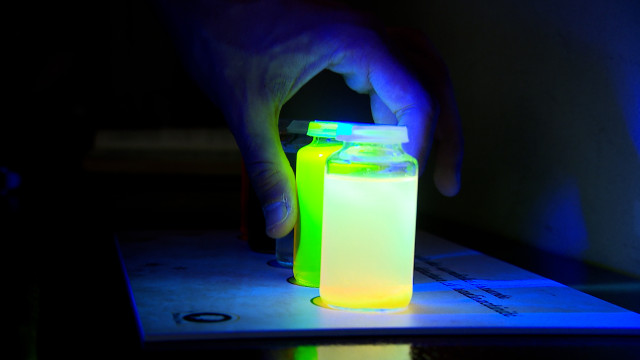

Photo by Patrick Sunfaun, Press

Olga Cherezova, budget advisor at ACEF East Montreal

Olga Cherezova, budget advisor at ACEF de l’Est de Montréal, shares this opinion (fairly). “No method is perfect,” she agrees. The word “fairness” is important, but even more important is the word “communication.” »

Methods of managing expenses between spouses are divided into two main categories.

In the first case, income and expenses are combined into a large whole. In the second, the shared expenses are divided into two parts – not necessarily equal, equal or fair…

Gross or net income?

Furthermore, in all of these major calculations, is it better to use gross income or net income? At ACEF de l’Est de Montréal, budget consultants always work with net income, “because that’s how people live,” says Olga Cherezova.

“We must also take into account allowances, tax credits and include all the income we receive,” advises the advisor.

However, the net wage rises in the second half of the year, when social charges are paid, and then falls again the following January. You have to follow the roller coaster.

In relatively simple situations, especially without children, it may be easier to work with gross income to calculate the proportion. However, given the tax brackets, the lower-income spouse may benefit.

“Music guru. Incurable web practitioner. Thinker. Lifelong zombie junkie. Tv buff. Typical organizer. Evil beer scholar.”