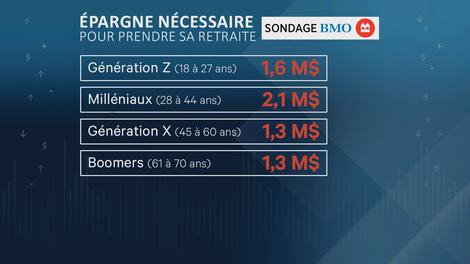

A BMO survey of generational expectations regarding their retirement needs revealed this week that millennials expect to have to save $2.1 million to retire, but what is that really?

In an interview on the “Le Bellin” program, the financial planner and wealth management advisor at Équipe Major, Fabien Major, believes that this number is very far from reality and that it is possible to retire with much less savings.

VAT News

“I think it will be one of the financial myths that we will remember for a long time, stories that we will tell ourselves when we grow up,” he said. “This is clearly exaggerated.”

The financial planner instead estimates that it is necessary to accumulate approximately $826,000 for a $70,000 annuity indexed for 25 years.

He believes that the fact that millennials believe they need a lot of money for retirement reflects a lack of understanding and financial needs.

“It is definitely a cry from the heart related to debt, because people who say to themselves that we have a standard of living of perhaps $125,000, there is a huge burden on the house, and on the two cars, which are not paid off, and he adds that full credit cards, take up a large part of “The budget. This is what we should not extrapolate, and we must quickly address the debts to put the money aside.”

“It's not hard to get over the hill as long as you save money and save money almost every month,” he adds.

However, property such as a home should not be included in this amount.

“Everyone I've seen who has included the house in their plans has taken a hit somewhere,” says the wealth management consultant. “We have seen a significant rise in value in the last 10 years, but we have to move on.”

“If someone lives outside major centers and wants to be closer to their children and grandchildren, for example, if they sold their house for $500,000 outside of Montreal and they want to buy a small apartment closer, for $500,000, we may not have enough money.” He continued. We rarely include housing in our calculations, as it is a lifestyle expense that will always be necessary.

Mr. Major strongly advises the public to take care of their personal finances as soon as possible to avoid being caught by surprise when they approach retirement.

“The most unfortunate thing is that there are people who are not making investment choices and are not interested in them, so they are not making any money, they are not making any benefit,” he says. That's why at the end of our career, perhaps at age 50, we'll need to put a lot of money aside to make up for the interest we're not earning because we're not interested in his money. “I think this is the tragedy.”

Watch the full interview in the video above

“Music guru. Incurable web practitioner. Thinker. Lifelong zombie junkie. Tv buff. Typical organizer. Evil beer scholar.”

![[VIDÉO] LPHF: Like Cole Caufield, Ann-Renée Desbiens has her own unique shoes](https://m1.quebecormedia.com/emp/emp/63411_07894593662cf2-8a9e-4bd6-aa34-c999d634a876_ORIGINAL.jpg?impolicy=crop-resize&x=0&y=291&w=3492&h=1966&width=1200)

More Stories

La Grande Vie Grand Prix: The stars align for a Montreal resident

The event was disrupted by protesters Baptism of fire for the “Santi Quebec rifle”

Low interest rates: “There is hope,” says senator and economist Clement Gignac.