Caisse de depot identified a total of 26 loans that put one of its top executives in a conflict of interest situation, three months after he was asked to sell his shares in the Terrebonne shopping mall.

• Read also: Hidden conflict of interest in subsidiary Otéra

• Read also: Camouflage operation in Caisse: QS invites leaders to come and explain themselves to the Province of Quebec

Our FBI consulted other classified documents from Otéra Capital, Caisse’s commercial loan subsidiary, about its senior vice president, Paul Chen.

photo courtesy

Paul Chen, Senior Vice President and Chief Investment Officer at Otéra Capital.

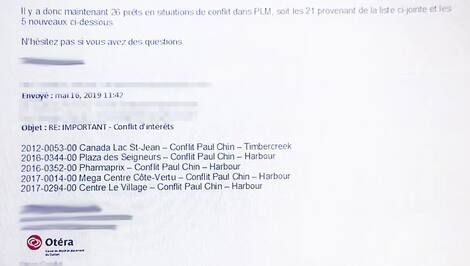

In May 2019, while a major ethics clean-up was in full swing internally, analysts at Otéra responded to a series of emails with the subject: “Important – conflict of interest.” They are working on a computer tool to list conflicts of interest, which was created a few months ago after a series of embarrassing revelations from our Ethics Investigations Office in Utera.

Therefore, there are now 26 loans in existence [sic] conflict […]21 from the attached list and 5 new lists below,” a senior business analyst wrote May 16, in an email.

Prior to creating this IT tool, Otéra did not have a dashboard to monitor conflicts of interest. The organization relied on the statements of its employees.

The oldest loans added on that day date from 2012 and relate to Place Alma, a shopping center in Lac-Saint-Jean.

Internal documents from Otéra indicate that Toronto real estate giant Timbercreek is linked to this loan file. However, Paul Chen’s wife, Julie Newlet, was concurrently working for Timbercreek, where she held management positions from 2012 until February 2022.

Otera argued yesterday that Mr. Chen declared all of his interests in 2013, “including in relation to Timbercreek.”

“[M. Chin] Always acts in good faith and in a transparent and cooperative manner on managing conflicts of interest. What was missing and which has been strengthened, among other things, is related to the framework for managing these disputes, an Otéra spokesperson said in a written statement.

Yesterday, we disclosed that Otéra leaders urgently notified their teams in February 2019 about the personal interests of Mr. Chen in the Terrebonne Mall, to whom Otéra has granted loans totaling $20.7 million. Then Mr. Chen had to sell his shares within three months.

Mr. Chen remains in office today, because according to Otera, this situation has no “joint action” with the elements that led to the dismissal of its leaders in 2019.

Otéra’s 2019 findings on its senior vice president have not been publicly disclosed by Caisse or its then CEO, Michael Sabia. The external investigation report commissioned in 2019 has since remained confidential, despite our repeated requests for it.

“Music guru. Incurable web practitioner. Thinker. Lifelong zombie junkie. Tv buff. Typical organizer. Evil beer scholar.”

More Stories

Pandemic: Quebeckers are getting richer while Canadians are getting poorer

Expected congestion Several areas to avoid on the road this weekend

Bombardier records a decline in profits and revenues