The requests for administrative assistance relate to the accounts of US clients whose Swiss companies have not yet consented to report their data to the IRS.

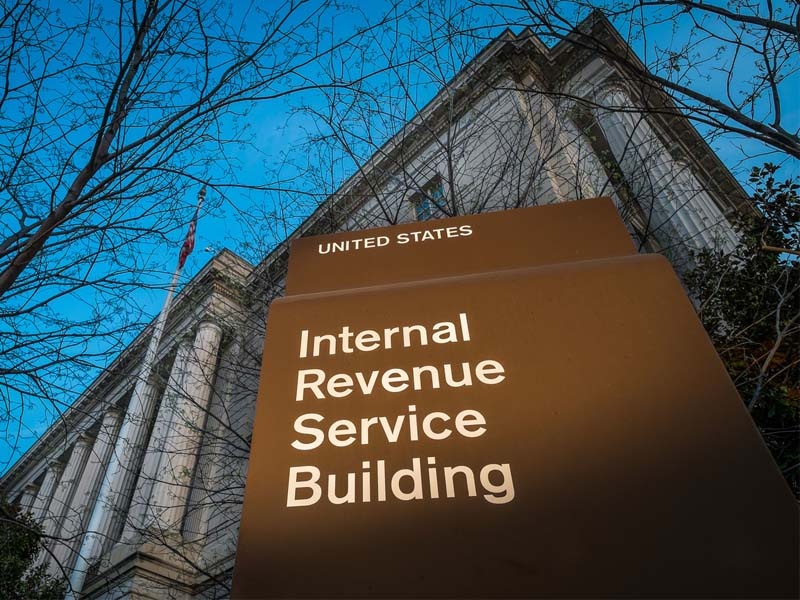

Following a hunt for possible fraudsters in Switzerland, the US Internal Revenue Service (Internal Revenue Service) obtained information from Swiss authorities about accounts in 25 Swiss banks. Uncle Sam’s tax authority has filed several requests for administrative assistance in this direction in recent years.

The requests for administrative assistance concern the bank accounts of US customers whose Swiss companies have not yet consented to share their account data with US authorities, according to the administration’s final decision. Federal Contribution (AFC) was released on Tuesday. The companies involved reported these customers’ information to the IRS only in aggregate form.

The requests for information concern top Swiss bank UBS and a number of cantonal companies, as well as life insurers such as Post Finance, Helvetia and Swiss Life, as well as several wealth management firms.

Requests for administrative assistance from US tax authorities are based on an agreement between Switzerland and the US aimed at implementing the FATCA Act (“Foreign Account Tax Compliance Act”). In June 2021, tax authorities across the Atlantic sought customer data from around forty Swiss banking firms.

“Certified food fanatic. Extreme internet guru. Gamer. Evil beeraholic. Zombie ninja. Problem solver. Unapologetic alcohol lover.”

More Stories

Opposite Skylight – Australia – A-League Men 2023/24: Final Places

Prince Harry's disappointment with his “former residence” in the United Kingdom: He thought he would “be with her forever”.

Three people were arrested in the United Kingdom