Laurentian Bank received a dose of love Thursday on Bay Street, which made its stake jump into the Toronto Stock Exchange.

The Quebec Financial Corporation title reached its highest level in 52 weeks on Thursday after winning the backing of RBC Capital Markets.

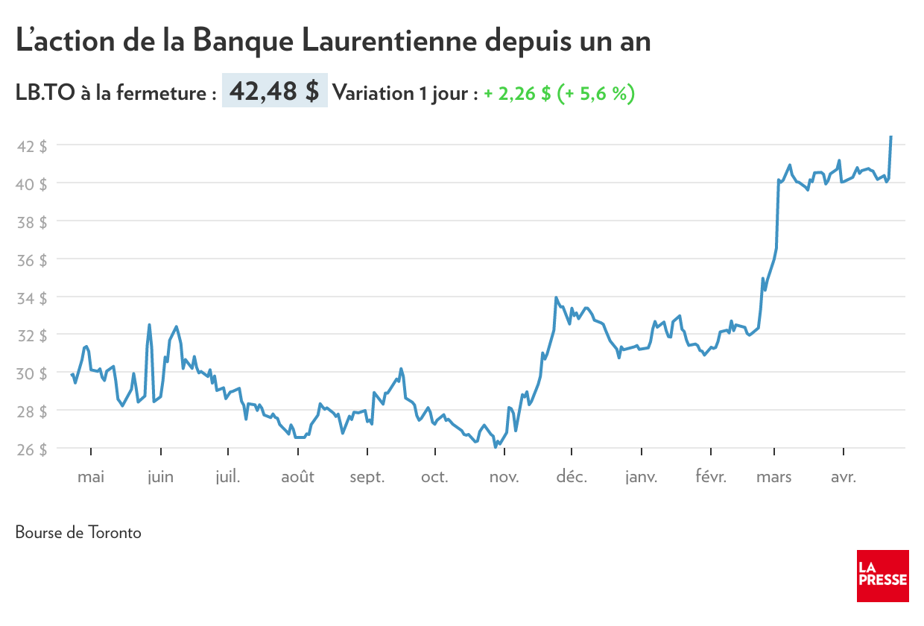

Laurentian stock rose 5.6% to $ 42.48.

RBC’s Darko Mihelic became the first analyst in long to recommend buying Laurentian stocks. The other nine analysts providing formal coverage to the bank still suggest either liquidating the stock or keeping it.

Darko Mihlyk argues that canceling union certification is a “catalyst” that should lead to a higher reassessment of the bank’s work.

“Withdrawing union certificates makes the bank switching process easier,” says Darko Mihilek. The union has brought many challenges to the bank. Negotiations with the union were a major drain on top management’s time, and earlier threats of labor dispute hampered the bank’s operations. ”

This expert also indicates that the bank intends to make changes in certain situations and that the union seemed less flexible or willing to accept these changes.

“The new CEO, Rania Lloyin, can now operate more freely than her predecessors, and management can focus more on business and less on union issues.”

Acquisition target

Additionally, he said, the lack of a bank union could increase the likelihood of seeing Laurentian purchased. No buyer wanted to bid in the past due to a union, he says.

According to him, other banks or financial services firms may want to take over due to the small size of Laurentian and the potential for synergies to be achieved.

He adds that Laurentian’s present value, less than the value of its tangible assets, is another factor that makes the deal worthwhile. Darko Mihelic also expects the bank’s stock market assessment to reflect this possibility.

This is why he is now recommending his clients to purchase Laurentian Stock. He set the target price at $ 49 because he believes that a bank’s stock should trade at a minimum in line with the value of its tangible assets in the absence of a union within the organization.

After losing 30% of its value in 2020, Laurentian has rebounded about 36% since the firsthe is January. Even before Thursday’s jump, the stock has risen sharply this year for several reasons.

First, the banking sector as a whole was pulled back in February with interesting quarterly results being presented by major Canadian banks. Without being unusual, the results presented by Laurentian are well received by investors. There was also a union vote last month to dismantle the union. Finally, hedging of short positions by speculators may also have helped fuel the stock’s advance.

Laurentian has been run since October by Rania Llewellyn, who previously worked in Scotia. It took over from François Desjardins, who left in the middle of last year after launching an ambitious transformation plan six years ago. This plan directs Laurentian toward financial advisory and digital services. The number of branches has grown from 150 six years ago to about 60 today.

Rania Lloyin has already announced several organizational changes, but she has yet to define the strategic direction she wants to bring to the financial institution.

“Music guru. Incurable web practitioner. Thinker. Lifelong zombie junkie. Tv buff. Typical organizer. Evil beer scholar.”

![[IMAGES] Someone tries to set himself on fire outside Trump's courthouse](https://m1.quebecormedia.com/emp/emp/Capture_d_cran_2024_04_19_134909afe99a84-cf29-4f06-9dc2-9eb9ce265b46_ORIGINAL.jpg?impolicy=crop-resize&x=0&y=201&w=1074&h=604&width=1200)

More Stories

Provinces ask Ottawa to stop encroaching on their jurisdictions | Federal budget 2024

After giving big bonuses to the bosses, the deposit and placement fund fires the employees

70 million in Lotto Max. To make sure you win