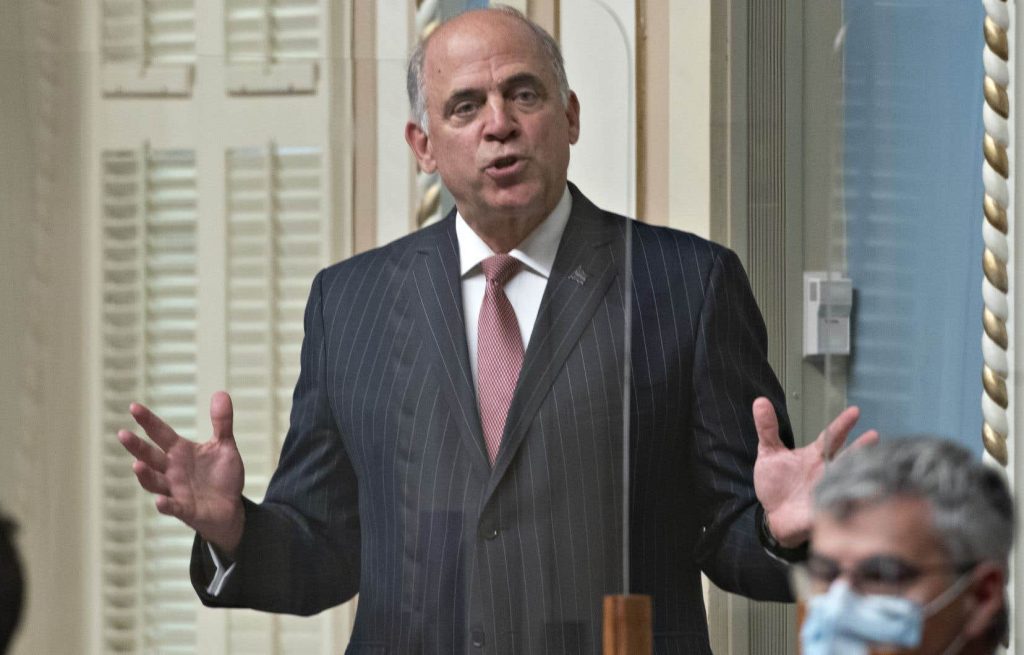

A report published on Wednesday found that Economy Minister Pierre Fitzgibbon used his discretion to award $68 million in financial aid to companies that do not meet the criteria for a program created due to the pandemic.

Thus ten problem loans were granted during the period from March 2020 to March 2021, examined by the team of Quebec’s auditor general, Guylaine Leclerc.

One of the eligibility criteria requires businesses to be profitable before the pandemic. This criterion was not met in at least six out of ten loans examined by the audit.

Investissement Québec (IQ) was the government’s agent for the Enterprise Interim Coordinated Action Program (PACTE), which aims to help companies preserve their working capital during the pandemic.

According to the audit report, companies whose application was rejected by a regional AI office got a positive response after contacting other intelligence units, the Specialized Finance and Key Accounts divisions.

In the press conference that followed the presentation of his report to the National Assembly, Mr. d.I Leclerc explained that Mr. Fitzgibbon made use of the provisions of the Internal Governance Manual on the condition that he could “modify the terms and authorize loans according to the needs of the files”.

“I don’t know if there is favoritism or not,” the master said.I Leclerc. All I can say is that there are 10 companies that we found that do not meet the advertised criteria. “

To make his decisions, Mr. Fitzgibbon relied on analyzes from the specialized finance department and the main accounts under which he had to give them loans because they were “considered a strategy for Quebec’s economy”.

NSI Leclerc claimed that it was unable to obtain the criteria to declare that the company is very important. “To judge whether it was a strategic business, I wanted to have criteria for what a strategic business is,” she said. So without standards, it becomes difficult to judge. “

The audit team at M.I Leclerc examined 22 loans granted under PACTE. Several problematic elements were identified in ten cases. One company got help to support its growth, not to deal with the pandemic. The second loan was to finance capital expenditures that were not eligible for PACTE.

In addition to six companies helped when they were unprofitable before the pandemic, two have secured funding without showing future profitability.

Mr. Fitzgibbon denied that he had exceeded the standards. “I’m very happy with the government, and I think we’ve been very good at business,” he said.

The minister called for the Quebec government to be flexible, because help that was delivered quickly could not foresee all cases. “People who know the field of lending will understand that it is impossible to standardize everything,” he said.

Mr. Fitzgibbon admitted that the bankruptcy rate of companies that have benefited from PACTE, which currently stands at 0.5%, will rise. Our rate is very low, but it will go up. “There are people who will not be able to pay,” he said.

As of March 31, 2021, 1,076 companies have received $850 million from PACTE.

PQ’s spokeswoman for Economics, Méganne Perry Mélançon, asked the minister to highlight all loans granted. “If there is no favouritism, we will have to explain it to us and make sure of it,” the MP said at a press briefing.

For his part, Mr. Fitzgibbon emphasized that he had no personal interest in these companies, without however ruling out the possibility of links with the directors. “Of course I know people, I know everyone,” he said.

IQ, who declined to name the ten firms, objected that Mr. Fitzgibbon exercised no discretion because his decisions were based on analysis. “We do not disclose the names of the companies targeted by the loans referred to by the auditor general for reasons of confidentiality,” company spokeswoman Isabelle Fontaine explained.

Watch the video

“Music guru. Incurable web practitioner. Thinker. Lifelong zombie junkie. Tv buff. Typical organizer. Evil beer scholar.”

:format(url)/cloudfront-us-east-1.images.arcpublishing.com/lescoopsdelinformation/L2F6OCLVY5CBBNQ32DX5S7TOBA.jpg)

More Stories

STTR staff wins $1 million: 'It's a bit unreal'

Quebec Airport: 1.7 million passengers in 2023, but moderate growth over the next two years

Food intolerance: tests out of reach